An Unbiased View of What Is Trade Credit Insurance

Wiki Article

Getting My What Is Trade Credit Insurance To Work

Table of ContentsUnknown Facts About What Is Trade Credit InsuranceIndicators on What Is Trade Credit Insurance You Need To KnowThe What Is Trade Credit Insurance PDFs

Throughout the year, if any of those customers go breast or do not pay, then we will certainly make the settlement. We take a look at the entire turnover of a company as well as we finance the totality. "What we're translucenting electronic systems is that people can go online and also can market a solitary invoice.

The systems can see the invoices that are impressive and also can make an offer to get those outstanding billings. What the client can after that do is take the choice to guarantee that single billing. Once that invoice is guaranteed, it's essentially a warranty that the invoice will certainly be paid - What is trade credit insurance. "At Euler Hermes, we believe there's mosting likely to be a change in the way profession credit report insurance policy is dispersed.

Little Known Facts About What Is Trade Credit Insurance.

Required a broker? See our overview to discovering the best broker.

A supplier with a margin of 4% that experiences a non-payment of 50,000 would need 25 equivalent sales to make up for a solitary circumstances of non-payment. Credit history insurance minimizes against this loss. You can reduce investing on credit history details as that's covered, and you will not need to squander sources on chasing collections.

You may be able to bargain beneficial terms with your suppliers as a credit report insurance plan reduces the influence of an uncollectable bill on them and possibly the entire supply chain. Credit scores insurance policy is there to help you prevent as well as mitigate your trading risks, so you can establish your service with the knowledge that your accounts are safeguarded.

An organization wanted to broaden sales with its present customers but was not totally comfortable using them greater credit line. They spoke to Coface credit report insurance policy to cover the higher credit line so they click to read more could raise the quantity of credit rating offered to customers without threat - What is trade credit insurance. This let them expand profits as well as deliver more revenues.

The 25-Second Trick For What Is Trade Credit Insurance

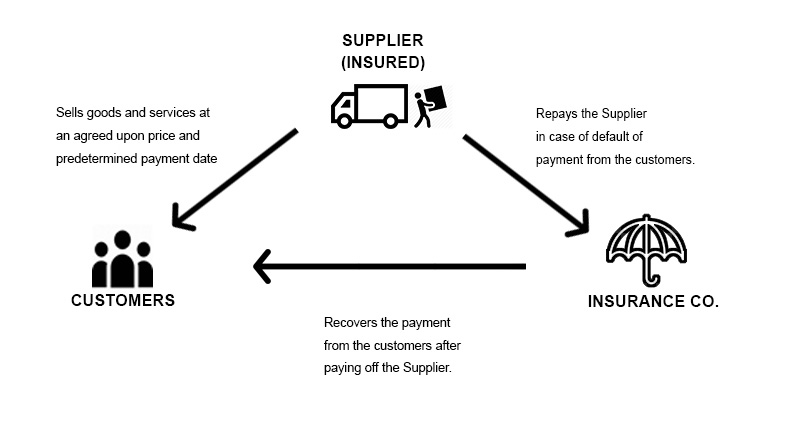

"From the preliminary objective of giving comfort to our banks, the solution added deepness to our company decisions." The communication permitted the firm to examine its customers' condition more accurately and has actually been a beneficial tool in company growth.Australian organizations owe around $950 billion to various other businesses. Which indicates it's vital to have securities in position to make sure that in case a financial institution does not meet its commitments, the organization can still recoup its money. Securing profession credit rating insurance policy is one means you can do this. Trade credit scores insurance policy provides cover when a client either ends up being financially troubled or does not pay its debts after a particular period (which is laid out in the insurance plan).

"In the event a financial debt is overdue, the policy owner may be able to claim approximately 90 per cent of the quantity official website of that debt, taking right into account any extras that may be appropriate," he includes. When it involves accumulating the debt, try here usually the insurance provider will certainly have its own financial obligation debt collector and also will certainly go after the debt in behalf of business.

Report this wiki page